XERO

SmartyGrants currently has a Xero (online accounting software) integration.

Please contact SmartyGrants to discuss connecting your SmartyGrants account to Xero.

For further details on synchronising Xero and SmartyGrants and set-up options, see below.

Connecting SmartyGrants to Xero

Integration options

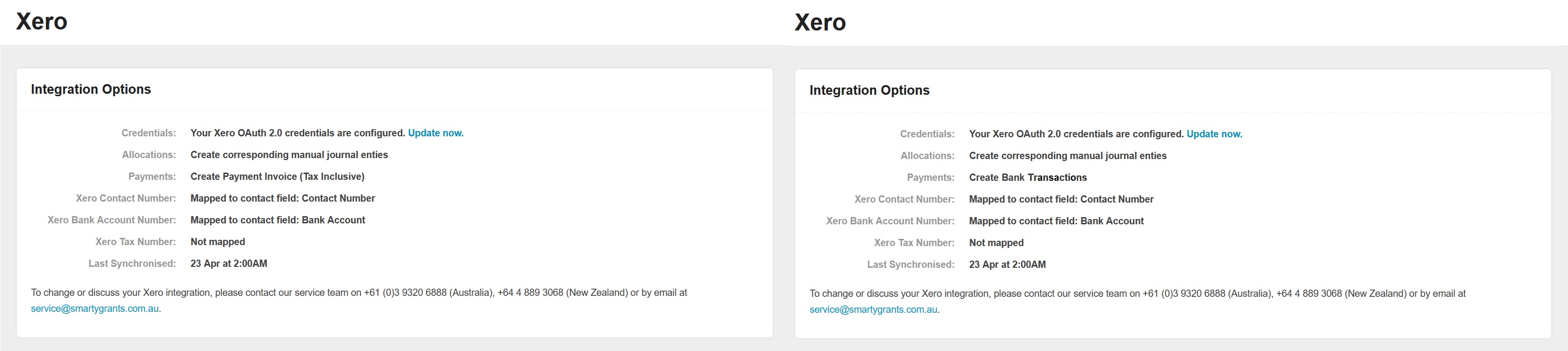

To find details of how SmartyGrants is configured to integrated with Xero:

Go to 'Account Settings'

Click on Xero under the Integrations group.

When SmartyGrants creates an item in Xero it will maintain a link between the SmartyGrants item (e.g. a payment or funding allocation) and the corresponding item in Xero.

The following integrations options exist and can only be changed by the SmartyGrants service team:

Allocations options

Do Nothing - SmartyGrants will do nothing in Xero when a funding allocation is created or edited

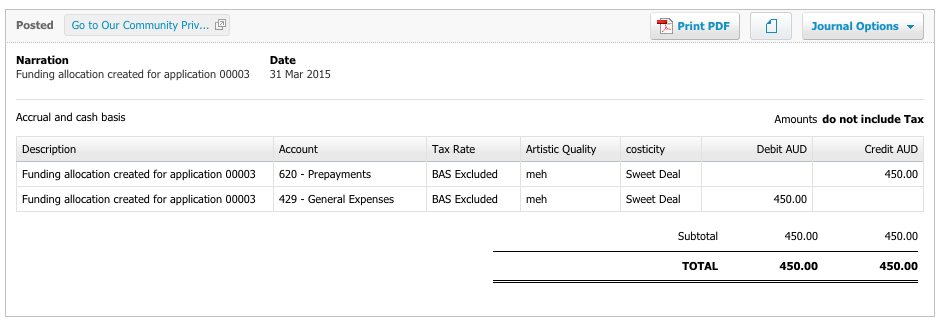

Manual Journal - Funding allocation can be linked with Manual Journal entries in Xero. When an allocation is created or edited in SmartyGrants a corresponding journal entry will be created in Xero. Any changes to these linked manual journal entries through Xero will also be reflected in SmartyGrants.

Payment options

Do Nothing - SmartyGrants will do nothing in Xero when a payment is created or edited.

Create Bank Transactions - When a payment is marked as paid in SmartyGrants a corresponding bank transaction will be created in Xero. Any changes to these linked transactions through Xero will also be reflected in SmartyGrants.

Create Payment Invoice (Tax Inclusive) - When a payment is marked as paid (or scheduled, or approved - the organisation can decide) in SmartyGrants an invoice will be created in Xero. Any changes to these linked invoices through Xero will also be reflected in SmartyGrants. For example, if the invoice date or amount is updated in Xero, this will be reflected in SmartyGrants. In a similar way, if the invoice is deleted in Xero, the payment will be deleted in SmartyGrants.

Info: For further information on updating GST amounts in Xero, see GST and Xero – Inclusive or Exclusive below.

Xero Contact Number

A custom contact field is required in SmartyGrants to hold the ID of related Contact in Xero. SmartyGrants will automatically fill this field in when it needs to create a new contact in Xero; however, you can also prefill this field in any of your SmartyGrants contacts so that SmartyGrants will use a pre-existing contact in Xero for future payments or funding allocations.

Xero Bank Account

If you wish to pass back account details from SmartyGrants into Xero, you must select the custom contact field in SmartyGrants which holds these details. These details will then be used to populate the bank account field on any linked contact in Xero. This is a short answer field, and as such is not subject to the same validation rules as a validated bank account field. For this reason, be sure to use hint text and general content to inform applicants as to what should be entered (e.g., BSB & Account Number in the format 1234561234567 (where the first set of digits is the BSB and the second set of digits is the Account Number)).

Xero Tax Account

If you wish to pass the tax number (ABN/NZBN) from SmartyGrants into Xero, you must select the custom contact field in SmartyGrants which holds these details. These details will then be used to populate the tax number field on any linked contact in Xero.

Synchronising Xero and SmartyGrants

Typically changes made in SmartyGrants are reflected within Xero within a matter of seconds. Changes made in Xero however may not show up immediately in SmartyGrants because SmartyGrants only checks for changes in Xero at 2am (AEST/AEDT). If you wish to see your changes in Xero appear more quickly in SmartyGrants then you can manually resynchronise the two systems each day. To synchronise SmartyGrants and Xero:

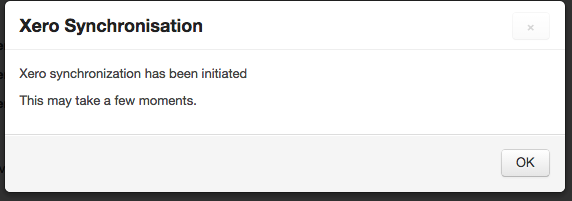

1. Go to 'Account Settings'

2. Click on Xero under the Integrations group.

3. Click on Sync Now

4. SmartyGrants will confirm that the synchronisation process has started. Within a minute or two the Last Synchronised time will be updated to confirm that SmartyGrants and Xero are now in sync.

Synchronisation errors

Errors that occur during synchronisation are reported on the Xero page under the Integrations group in Account Settings.

Errors will appear after clicking Sync Now.

It is good practice to check for errors after administering funding allocations and payments in SmartyGrants, or periodically if relying on the nightly batch process that synchronises changes made in Xero.

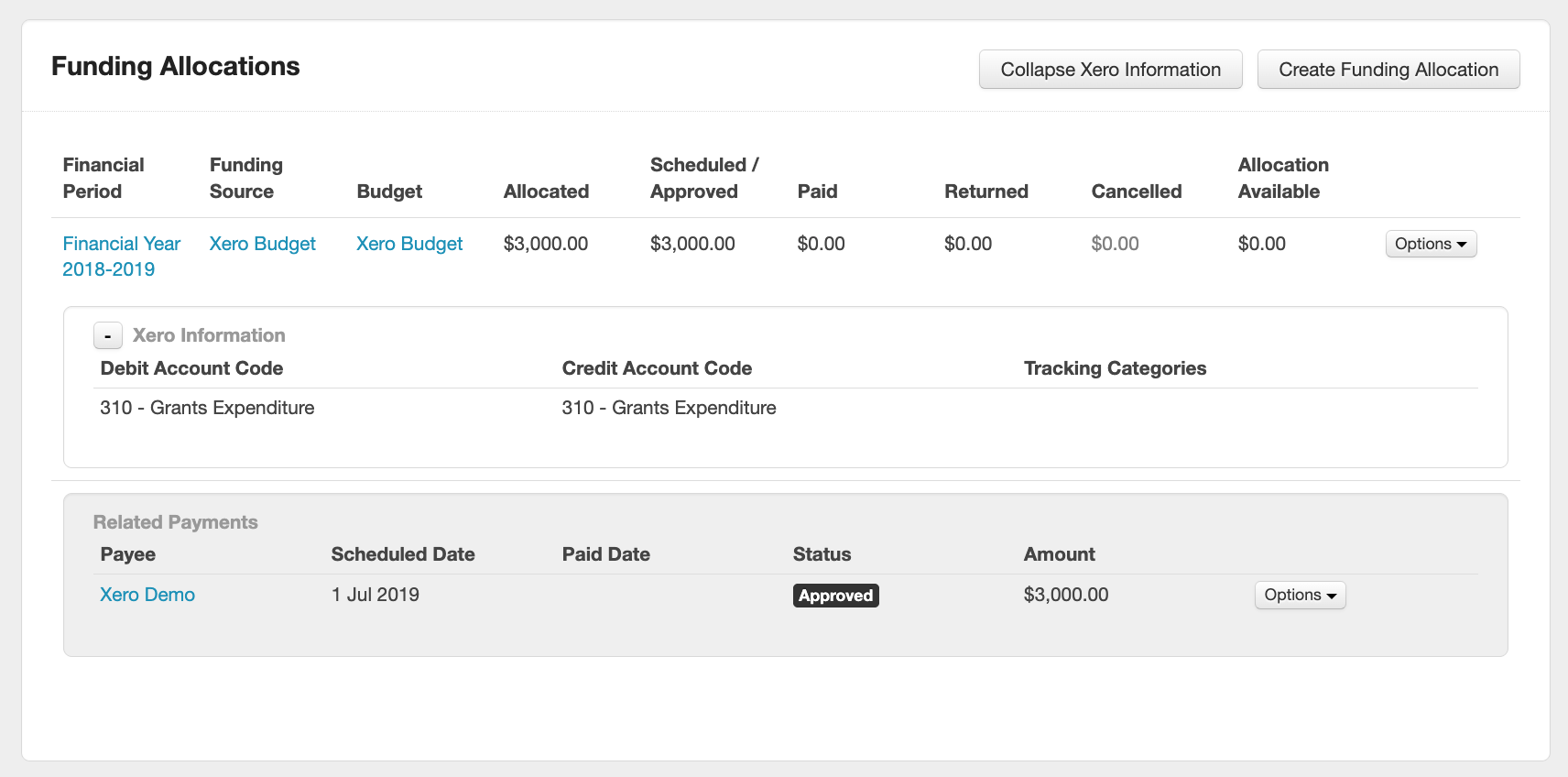

Setting defaults for Budgets and Budget Allocations

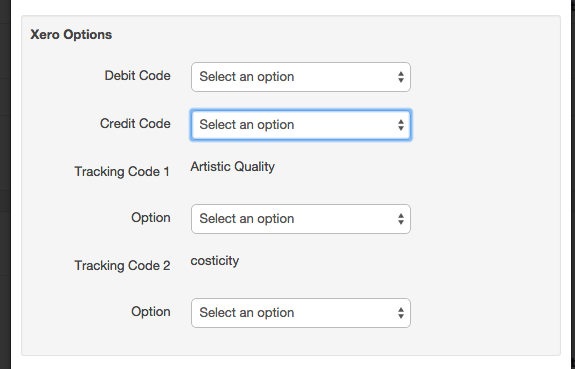

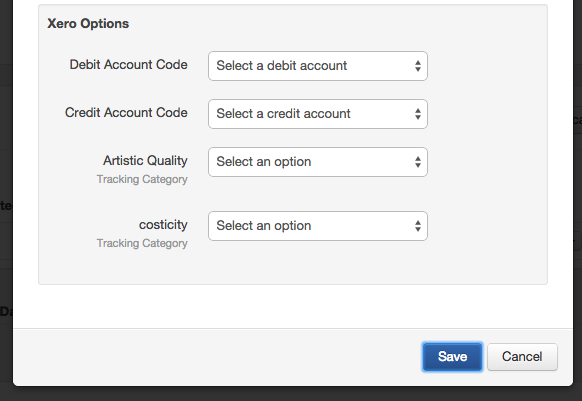

To make recording Funding Allocations and Payments easier you can record the following Xero details as defaults for both a Budget and Budget Allocations.

Debit Account Code (used for Manual Journal Entries)

Credit Account Code (used for Manual Journal Entries)

Tracking Codes (used for Manual Journal Entries, Bank Transactions and Invoices). Note tracking codes are optional.

To set these default values follow the instructions for settings up Budgets and Budget Allocations. In addition to the standard options you will be able to set the default Xero account and tracking codes for funding allocations or payments associated with a particular budget or budget allocation.

Important: Tracking options and account codes must be set up in Xero first, and synchronised with SmartyGrants, for them to appear in SmartyGrants as options for setting defaults. Tracking codes are optional.

If a Budget or Budget Allocation existed prior to enabling integration with Xero you will need to go back and set these details for the existing items before the defaults will show up when you create a funding allocation or payment.

Funding Allocations and Xero

When the the Xero integration option for funding allocation is enabled, creating or changing a funding allocation in SmartyGrants will be reflected as Manual Journal entry in Xero.

To begin, follow the instructions for allocating funding; however, you will also need to enter the debit and credit account codes for the manual journal, plus any tracking codes if they are in use.

Important: Tracking options and account codes must be set up in Xero first, and synchronised with SmartyGrants. Otherwise the corresponding Xero fields will be blank when setting up the funding allocation in SmartyGrants.

When you click save after creating, modifying or deleting a funding allocation, SmartyGrants will instruct Xero to update the relevant Manual Journal entry.

Handling of specific events that relate to funding allocations:

Creating a funding allocation in SmartyGrants

SmartyGrants takes the information that you entered and creates a related manual journal entry in Xero. SmartyGrants stores the ID of the Xero Manual Journal so that all future changes, be then in SmartyGrants or Xero are kept in sync.Editing a Funding Allocation in SmartyGrants

SmartyGrants takes any information that you entered and updates the related manual journal entry in Xero.Deleting a funding allocation in SmartyGrants

If a funding allocation is deleted in SmartyGrants, the manual journal entry will be marked as VOIDED in Xero.Creating a Manual Journal entry in Xero

This will have no effect in SmartyGrants.Editing Manual Journal entry Xero

Changes in Xero are reflected in SmartyGrants after the next synchronisation.

Note 1: Changes to a journal entry will only affect the related funding allocation, these change will not affect any payments linked to that funding allocation allocation.

Note 2: Additional line items added to a journal entry will be ignored in SmartyGrants.

Note: With editing Manual Journals in Xero, once a funding allocation in SmartyGrants is synced to Xero, changes to a Journal entry will result in the funding allocation being updated. Additionally, any additional line items added to a Journal entry in Xero (that do not originate in SmartyGrants) are ignored in SmartyGrants.

Deleting Journal entries in Xero

If a the Journal entry is deleted in Xero, then this change will be reflect in SmartyGrants after the next synchronisation, with the relevant funding allocation being deleted in SmartyGrants.However, if there are associated payments for the funding allocation in SmartyGrants, then it will not be possible to delete the funding allocation. This will result in Xero and SmartyGrants being out of sync.

Important: Voiding a manual journal in Xero deletes the associated funding allocation in SmartyGrants along with any payments. Payments in Xero are not changed and must be deleted, otherwise an error will occur when the two systems are synchronised.

Payments and Xero - Bank Transactions

There are two options for how SmartyGrants Payments are handled in Xero, either through bank transactions or invoices. See below for details on both options.

Option 1: Bank Transactions

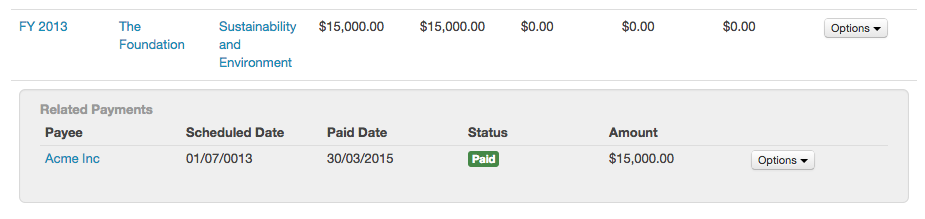

The first is through the creation of bank transactions. When a payment is marked as paid in SmartyGrants a corresponding bank transaction will be created in Xero.

Handling of specific events that relate to bank transactions:

Marking an approved payment as paid in SmartyGrants

A bank transaction record will be recorded in Xero and SmartyGrants will record the bank transaction id number back in SmartyGrants.SmartyGrants will use the Credit Account Code for the funding allocation as the account code for the bank transaction

The Tax Rate for a bank transaction is not set by SmartyGrants, instead Xero will use the default tax rate set for the relevant account code used in a bank transaction.

Editing a payment in SmartyGrants

The following changes in SmartyGrants will be reflected in Xero:Change of amount

Change of date paid

Change of bank account

Change of payee

Cancelling or deleting a payment in SmartyGrants

This will cause the bank transaction in Xero to be marked as voided.Editing a payment in Xero

The following changes made in Xero will be reflected in SmartyGrants:Amount

Date paid

Voiding a payment in Xero

If a payment is voided in Xero, then the associated payment will be deleted in SmartyGrants.

Important:

Tracking and account codes: Tracking and account codes are set for each funding allocation, and not for each specific payment. This needs to be considered when deciding how to set up funding allocations in SmartyGrants, e.g. for multi-year grants.

Reconciled payments (bank transactions only): Editing a payment in Smarty Grants (for example, changing the amount, the date or the payee) after the synced payment in Xero has been reconciled will result in an error in SmartyGrants and the two systems out of sync.

Approved payments (invoice transactions only): Editing a payment in SmartyGrants (for example, changing the amount, the date or the payee) after the synced payment in Xero has been approved will result in that information being updated.

Returned payments: Xero handles outbound (spend money) and inbound (receive money) payments separately. Returned payments entered into SmartyGrants are not synchronised with Xero and must be recorded in each system, in order to reconcile across the two systems.

Contacts maintenance: Editing the payee of a bank transaction in Xero doesn’t change the payee of the associated payment in SmartyGrants. Changes to contacts must originate in SmartyGrants and then be synchronised with Xero.

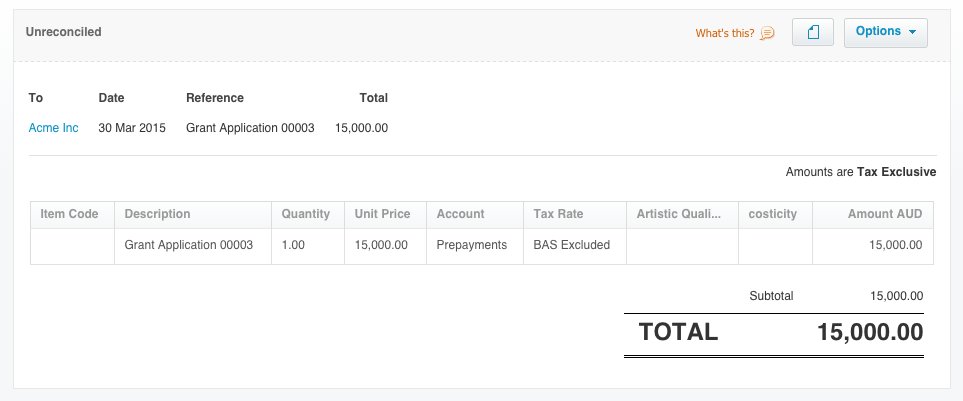

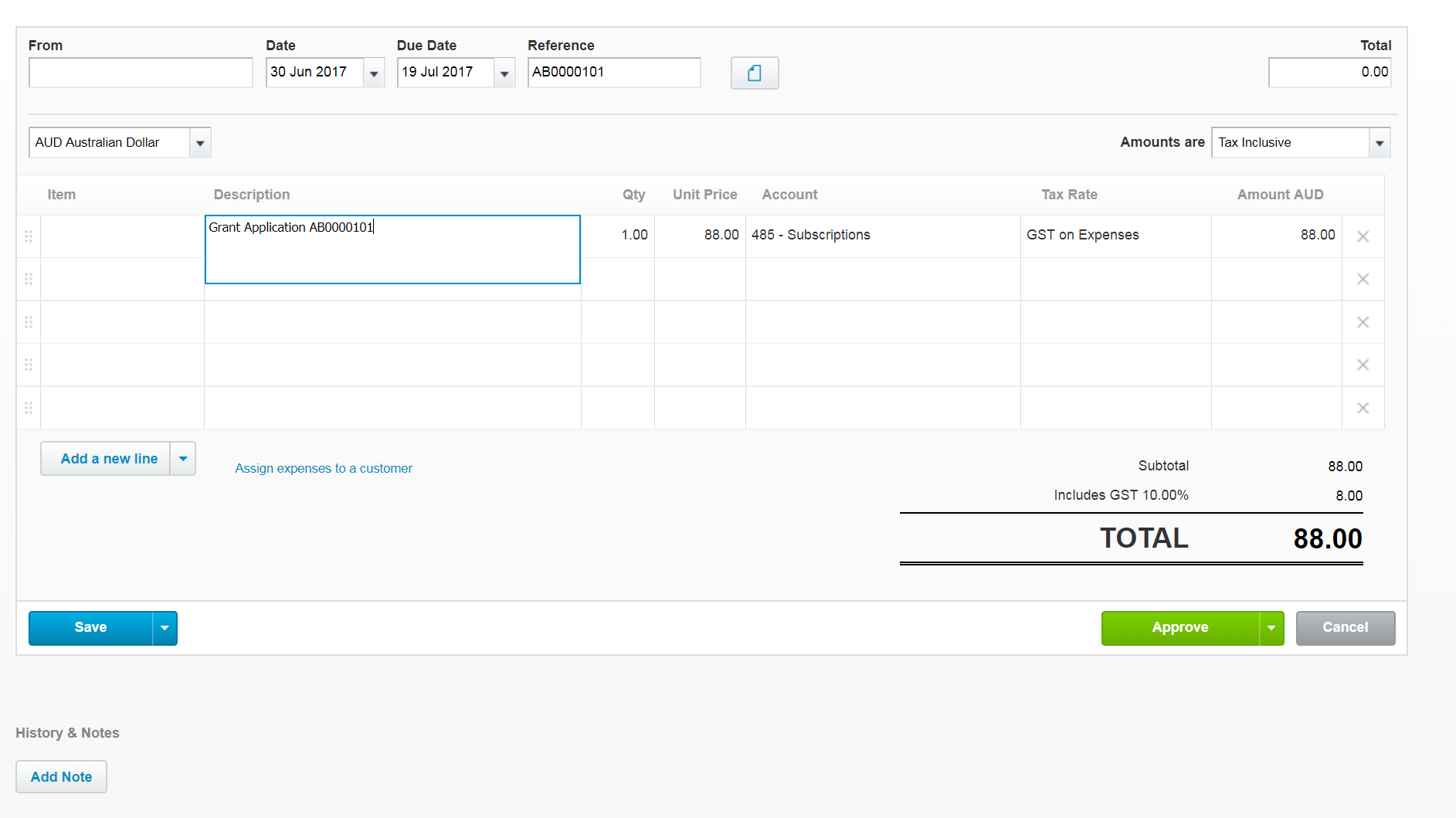

Option 2: Invoice

The second option uses invoices in Xero and it is possible to take advantage of Xero's batch payment processes. When a payment is marked as paid (or scheduled, or approved - the organisation can decide) in SmartyGrants an invoice will be created in Xero.

Handling of specific events that relate to invoices:

Marking an approved payment as paid in SmartyGrants

A draft invoice will be recorded in Xero.

Editing a payment in SmartyGrants

The following changes in SmartyGrants will be reflected in Xero:Change of amount

Change of date paid

Change of payee

Cancelling or deleting a payment in SmartyGrants

Provided there are no payments or credit notes recorded against the invoice in Xero, the invoice in Xero will be marked as voided

If there are payments or credit notes linked to the invoice, then an error will be displayed in SmartyGrants

Editing an invoice in Xero

The following changes made in Xero will be reflected in SmartyGrants:Amount

Date paid

Deleting an invoice in Xero

If an invoice is deleted in Xero, then the associated payment will be deleted in SmartyGrants

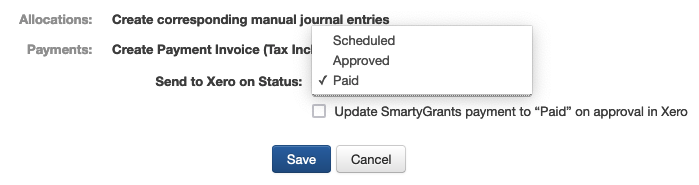

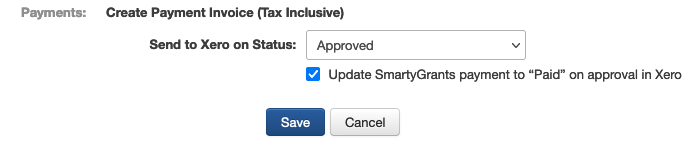

Invoice payment options:

The following settings can be set from the SmartyGrants UI:

The user can choose when payments are sent to Xero and whether or not the payment status should be set to "Paid" when the invoice has been approved in Xero (note: this is only applicable for invoices, not bank transactions as payments are only ever sent to Xero when set to "Paid").

If the user chooses the status of "Paid" (which is the default), then the checkbox to update the payment status to "Paid" is disabled as it is not applicable.

If the user chooses a status of "Scheduled" or "Approved", then the checkbox may be enabled. The effect of enabling this checkbox is that the payment status will be updated to "Paid" when the invoice has been approved in Xero and the sync process has been executed (either manually when the user clicks the sync button or by the scheduled overnight sync job).

Handling of specific events that relate to invoices (when the above settings are in use):

Marking an approved payment as paid (or scheduled, or approved - the organisation can decide) in SmartyGrants

A draft invoice will be recorded in Xero.

Editing a payment in SmartyGrants

The following changes in SmartyGrants will be reflected in Xero:Change of amount

Change of date paid

Change of payee

When the checkbox setting above is enabled, a payment already marked as "Paid" will not be able to reverted to "Approved" if that payment has already been approved in Xero. Instead, it will revert back to "Paid" and will create another invoice in Xero.

If a payment is changed from "Approved" to "Scheduled" in SmartyGrants (and the payment status used to send information to Xero is "Approved") then the invoice will not be deleted in Xero if the invoice is already approved in Xero.

Cancelling or deleting a payment in SmartyGrants

Provided there are no payments or credit notes recorded against the invoice in Xero, the invoice in Xero will be marked as voided.

If there are payments or credit notes linked to the invoice, then an error will be displayed in SmartyGrants.

If a payment is changed from "Approved" to "Scheduled" in SmartyGrants (and the payment status used to send information to Xero is "Approved") then the invoice will be deleted in Xero (provided that the invoice has not been approved in Xero yet) and the paid date will be deleted from SmartyGrants.

If the same payment is later "Approved" again in SmartyGrants, a new invoice will be created in Xero.

Editing an invoice in Xero

The following changes made in Xero will be reflected in SmartyGrants:Amount

Date paid

Where the relevant setting is applied, approving an invoice in Xero will mark it as paid in SmartyGrants.

Deleting an invoice in Xero

If an invoice is deleted in Xero, then the associated payment will be deleted in SmartyGrants.

Important:

Note regarding account codes: Currently, the Xero Integration populates the Credit Account Code as the line item on the invoice/bill. In some cases, a Debit account may need to be populated on the bill. This can either be updated manually, or the relevant Debit/Expense account can be selected as the Credit Account Code in SmartyGrants.

Tracking and account codes: Tracking and account codes are set for each funding allocation, and not for each specific payment. This needs to be considered when deciding how to set up funding allocations in SmartyGrants, e.g. for multi-year grants.

Reconciled payments: If an invoice is approved in Xero, modifying the payment in SmartyGrants will result in a Xero error.

Returned payments: Xero handles outbound (spend money) and inbound (receive money) payments separately. Returned payments entered into SmartyGrants are not synchronised with Xero and must be recorded in each system, in order to reconcile across the two systems.

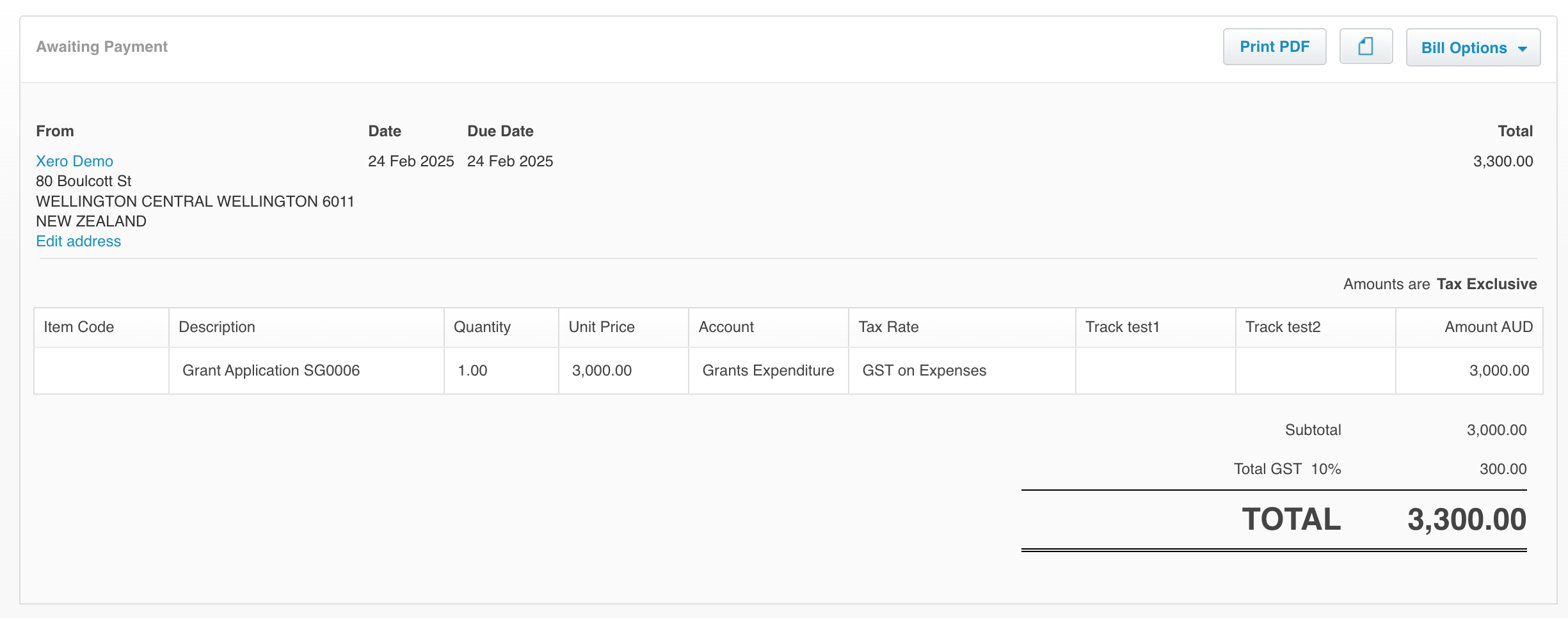

GST and Xero – Inclusive or Exclusive

SmartyGrants Payments do not include GST amounts. However, a GST component can be added to your invoices at a later date in Xero.

When configuring GST on your invoices in Xero, you will need decide whether you would like the new GST amount to additionally update the overall Payment amount in SmartyGrants, or if you would like the Payment amount in SmartyGrants to exclude the GST amount added in Xero.

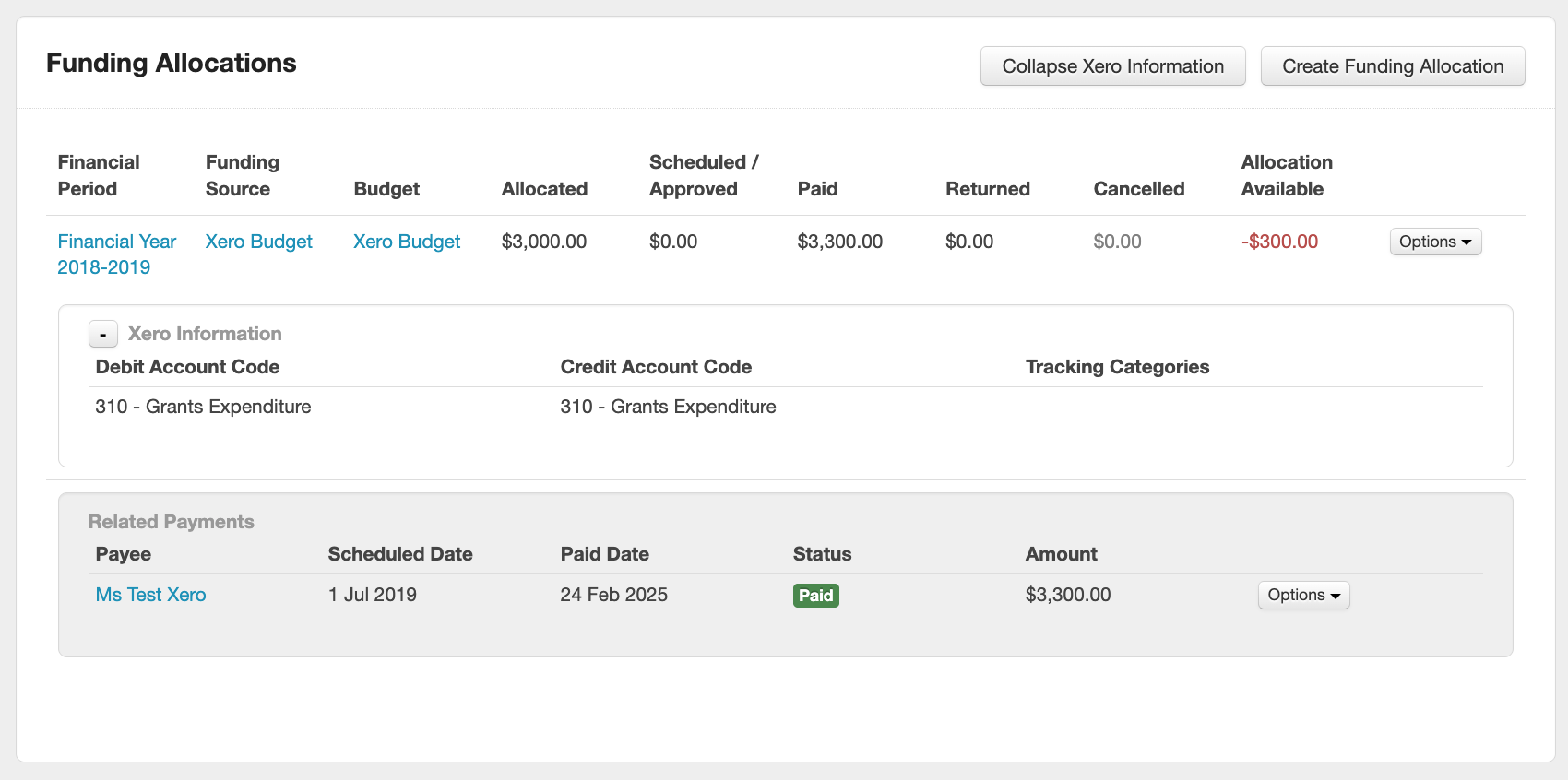

Example scenario of GST Added in Xero, which then automatically adds it in SmartyGrants:

A payment of $3000 (GST Exclusive) is added in SmartyGrants:

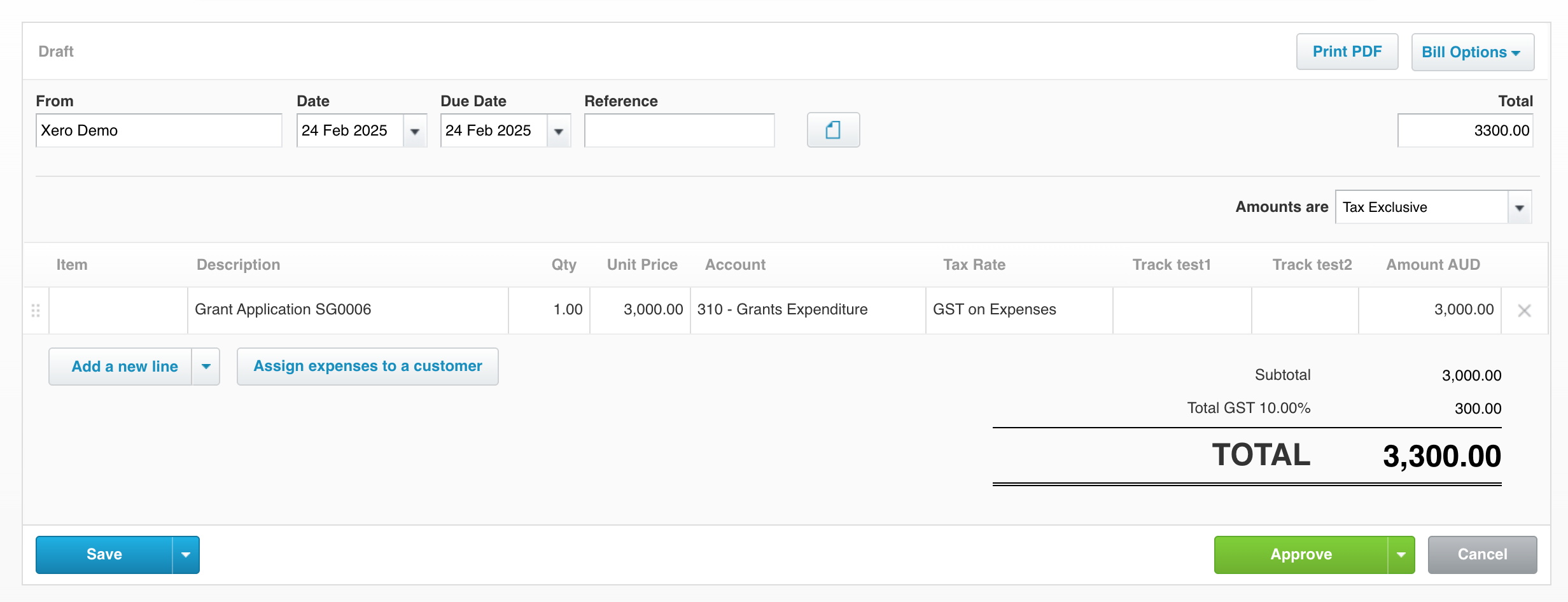

In Xero, GST is added at a rate of 10.00% and the Bill is Approved:

After Xero synchronisation, the status of the payment in SmartyGrants has been changed to “Paid”, and the payment amount has changed to the $3300 GST Inclusive amount:

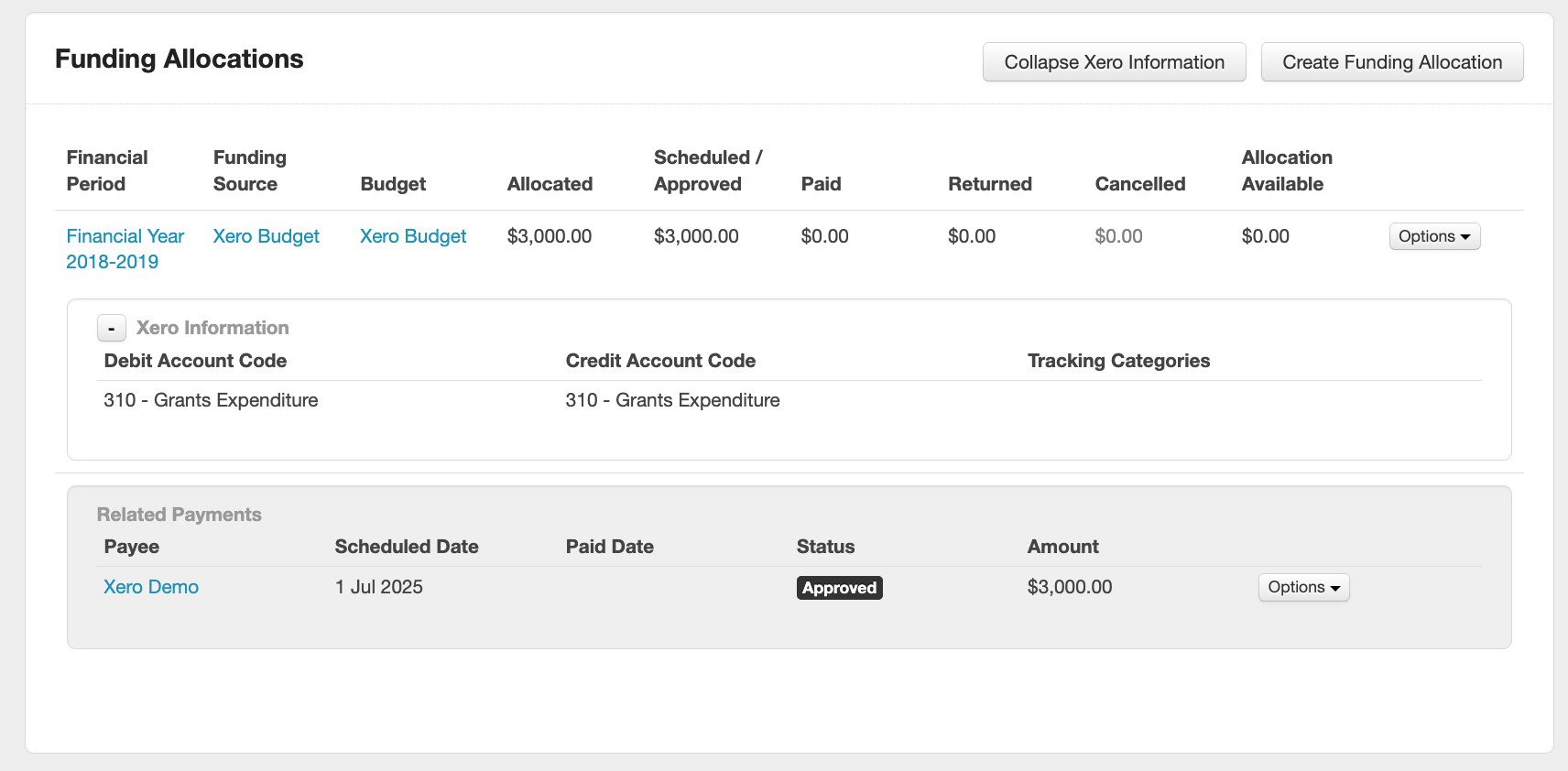

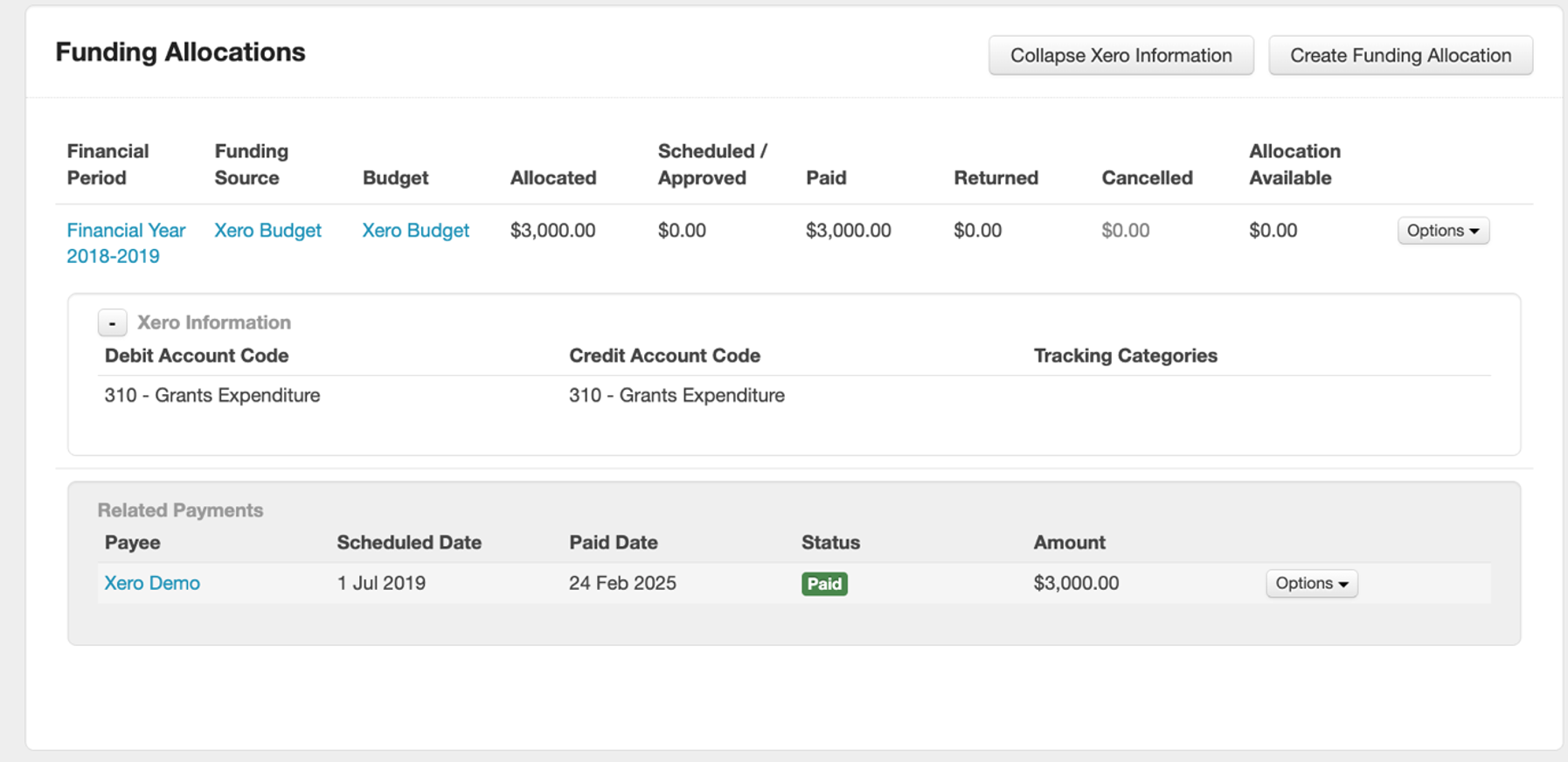

Example scenario of GST Added in Xero, but not in SmartyGrants:

A payment of $3000 (GST Exclusive) is added in SmartyGrants:

In Xero, GST is added at a rate of 10.00% and the Bill is Approved:

After Xero synchronisation, the status of the payment in SmartyGrants has been changed to “Paid” but remains at the $3000 GST Exclusive amount:

Info: Let us know at service@smartygrants.com.au if you would like to prevent any GST amounts added in Xero from being added to Payment amounts in SmartyGrants. This is achieved by synchronising the Xero Subtotal instead of the Total.